Algonquin Fixed Income 2.0

The evolution of fixed income: a core corporate bond fund with engineered advantages that give us a performance edge.

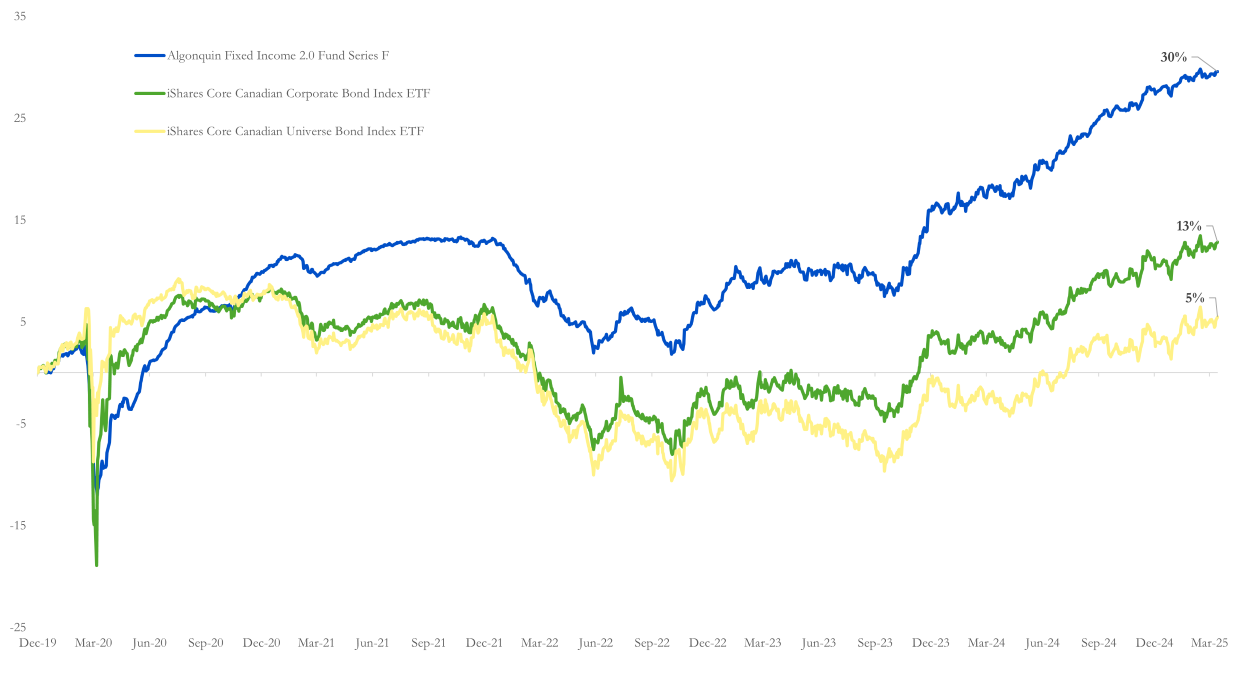

This Fund’s primary objective is to get investors better outcomes from their core fixed income. We do so by employing strategies that give us a greater ability to generate excess returns and manage downside risks.

The result is a core fixed-income product that seeks to outperform traditional bond funds.

In a nutshell

1. Core Portfolio.

We begin by constructing a core corporate bond portfolio based on where we see the best opportunities in credit markets.

2. Yield Enhancement.

We then enhance the portfolio yield by adding a layer of exposure to high-quality, investment-grade credit.

3. Active Duration Management.

Finally, we actively manage the fund’s interest rate exposure based on valuations across the yield curve.

| name | value |

|---|---|

| Fund Type | Alternative Mutual Fund |

| Eligibility | All Investors |

| RSP Eligible | Yes |

| Fund Codes (LP) | F Class: AGQ 301 A Class: AGQ 303 |

| Liquidity | Daily |

| Distributions | Quarterly |

| name | value |

|---|---|

| Avg. Credit Quality | Investment-Grade |

| Risk Rating | Low/Medium |

| Management Fee | F Class: 0.95% A Class: 1.45% |

| Performance Fee | None |

| Launch Date | December 31, 2019 |