Algonquin Debt Strategies Fund

This Fund offers investors higher yields and return potential without sacrificing quality.

Rather than searching for yield in lower-quality securities, we focus on extracting value from investment-grade credit. Our approach isolates the credit exposure of high-quality, large-cap companies while minimizing interest rate risk.

The result is the opportunity to earn attractive returns with a high degree of security and transparency.

For those investing through holding or operating companies, there is the added bonus of potential tax efficiencies, with returns characterized as active business income.

In a nutshell

1. Yield through high-quality credit.

Isolate and leverage the credit exposure of investment-grade bonds. Thus, earning attractive yields with minimal interest rate risk.

2. Active credit selection and tactical trading.

Target performance and relative value in specific issuers and sectors. Seek excess returns by capitalizing on inefficiencies within bond markets.

3. Business income.

The limited partnership’s returns are categorized as ‘active business income’, offering a unique tax benefit to corporate accounts.

| name | value |

|---|---|

| Target Return | 6-9% |

| Fund Type | Offering Memorandum |

| Eligibility | Discretionary Portfolio Managers & Accredited Investors |

| RSP Eligible | Yes |

| Fund Codes (LP) | CAD: AGQ100 USD: AGQ 100U |

| Fund Codes (Trust) | CAD: AGQ200 USD: AGQ 200U |

| name | value |

|---|---|

| OM Risk Rating | Medium |

| Liquidity | Monthly (25 days notice) |

| Management Fee | 1.50% |

| Performance Fee | 15% |

| Inception Date | February 2, 2015 |

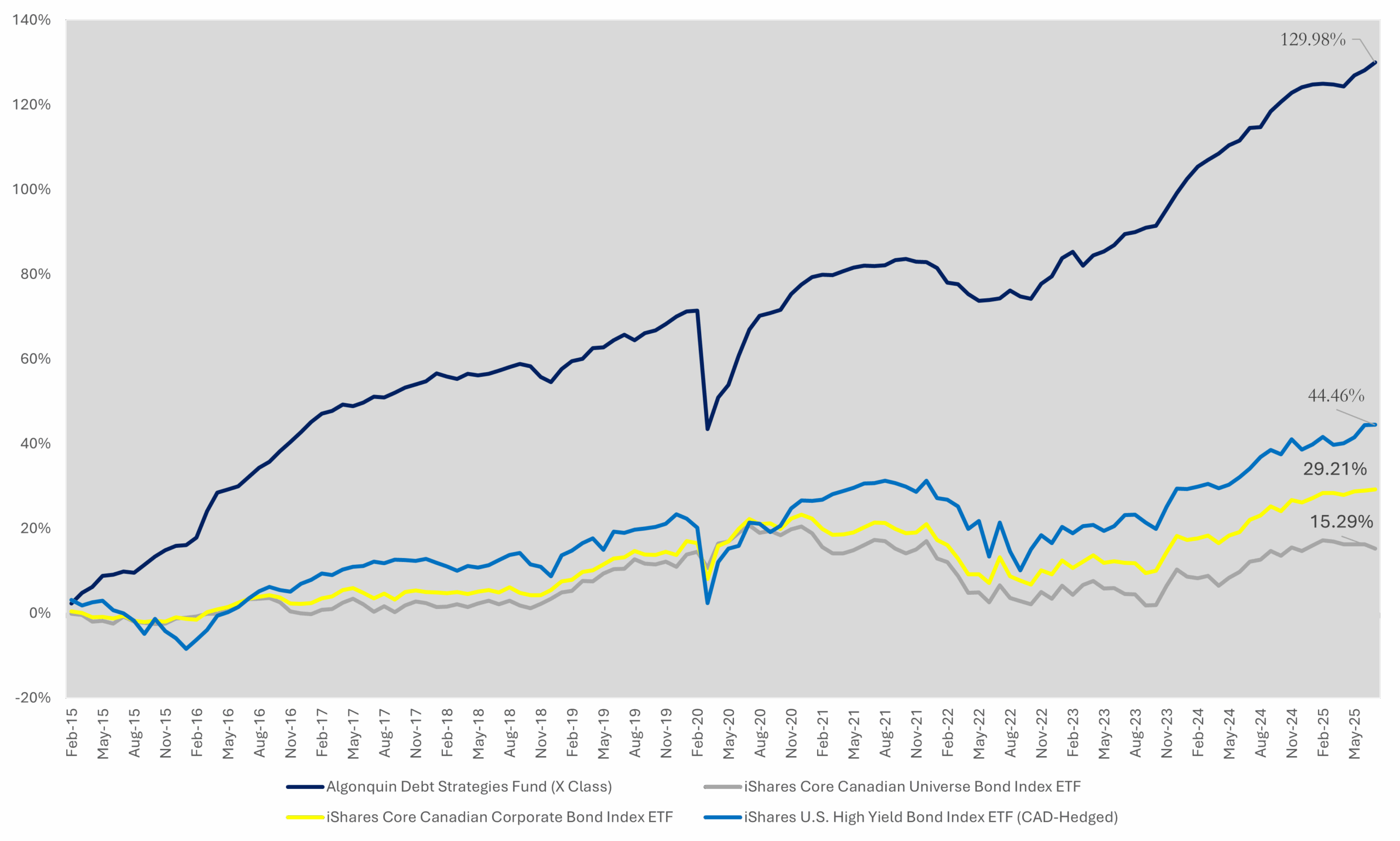

Performance

* X Class closed to new investors. Common ITD Feb 2nd 2015, to July 31st, 2025. Source: YCharts