The best way to explain our methodology is with the help of a hypothetical example. In the interest of numerical simplicity, we will be using round numbers.

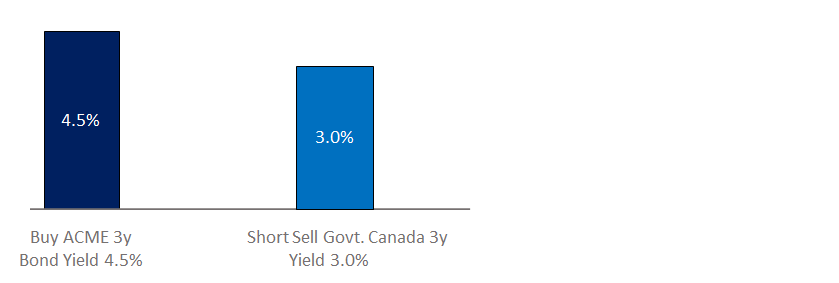

Let’s begin with an ACME 3y Bond yielding 4.5%. A traditional bond manager would purchase this bond in hopes of earning the 4.5% a year. Our approach is to buy the bond and simultaneously short sell the 3y Government of Canada Bond.